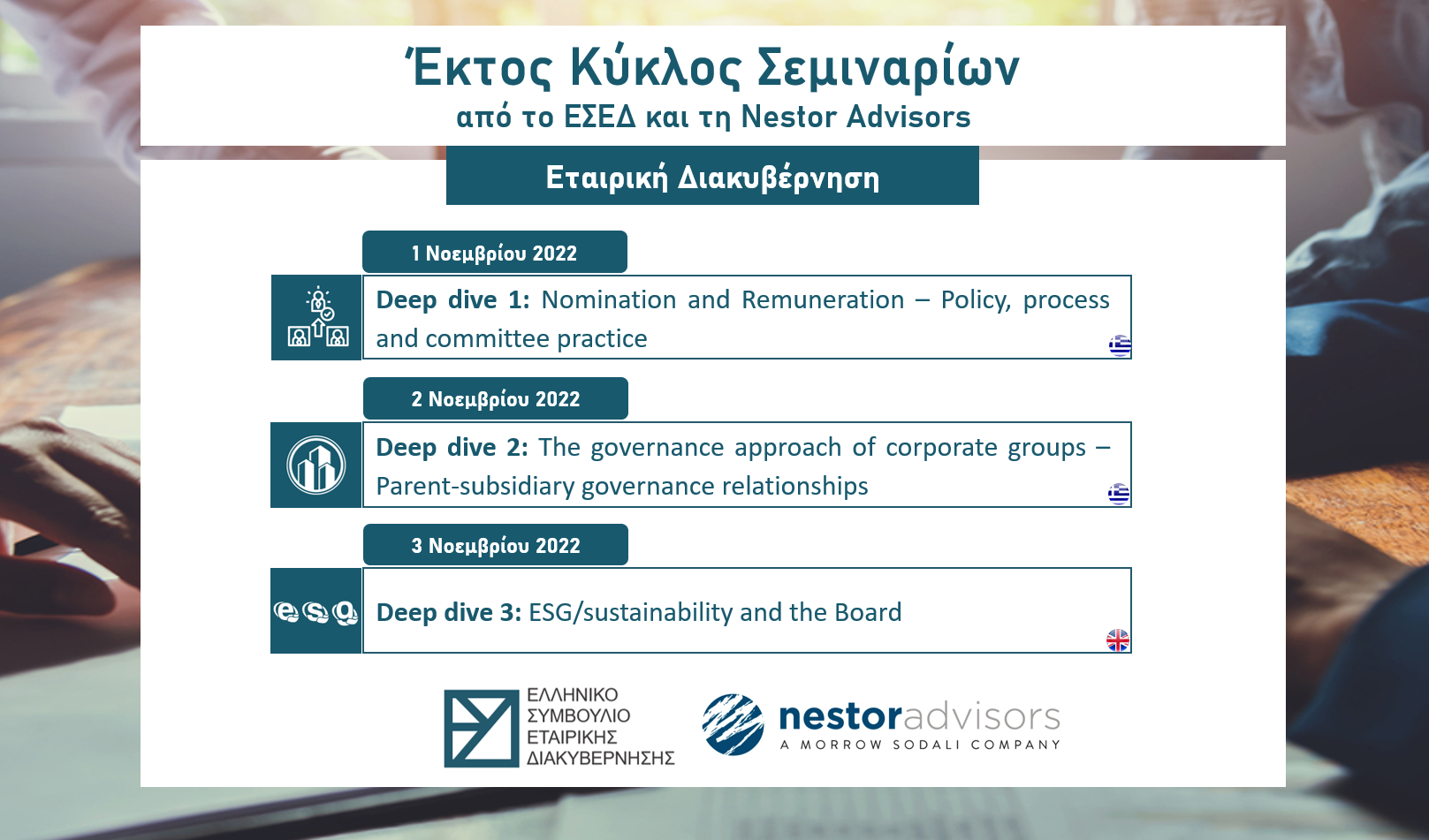

CG Seminar 06

"Best Practices in Corporate Governance: Boards, executives, investors, stakeholders”

Date: | November 1-2-3, 2022 |

Last day of registration: | October 31, 2022 |

Total hours of the seminar: | 9 |

Language: | Greek and English |

Location: | Online via Zoom |

Course fees: | Cost of the package that you will select + VAT (24%) |

Course description

Deep dive 1: Nomination and Remuneration – Policy, process and committee practice – in Greek

01 November 2022

- How to set up the board for success: board profile and composition, board responsibilities and oversight, expectations and practices.

- Relevant remuneration trends and practices: how is the landscape changing and what are the changes in Greece?

Deep dive 2: The governance approach of corporate groups – Parent-subsidiary governance relationships – in Greek

02 November 2022

- What are the key concepts and challenges in group governance?

- How should one go about developing and implementing group-wide policies?

- What is the role of subsidiary boards vis a vis parent boards?

Deep dive 3: ESG/sustainability and the Board – in English

03 November 2022

- What are the key concepts and challenges in governing E&S?

- What is the role of investor expectations in E&S?

- How should boards’ responsibilities and composition be structured to address E&S?

• All workshops are designed to be highly interactive, with a practical orientation. Throughout the workshops, live polls will be used to interact with the audience and participants may be asked to apply knowledge learnt to arrive at recommendations to mini-case problems. They will be run by an international faculty with a vast track record in training corporate officers and a truly extensive and varied corporate governance experience. Faculty will have good knowledge of the Greek regulatory environment and corporate practice.

01 November 2022

- How to set up the board for success: board profile and composition, board responsibilities and oversight, expectations and practices.

- Relevant remuneration trends and practices: how is the landscape changing and what are the changes in Greece?

Deep dive 2: The governance approach of corporate groups – Parent-subsidiary governance relationships – in Greek

02 November 2022

- What are the key concepts and challenges in group governance?

- How should one go about developing and implementing group-wide policies?

- What is the role of subsidiary boards vis a vis parent boards?

Deep dive 3: ESG/sustainability and the Board – in English

03 November 2022

- What are the key concepts and challenges in governing E&S?

- What is the role of investor expectations in E&S?

- How should boards’ responsibilities and composition be structured to address E&S?

• All workshops are designed to be highly interactive, with a practical orientation. Throughout the workshops, live polls will be used to interact with the audience and participants may be asked to apply knowledge learnt to arrive at recommendations to mini-case problems. They will be run by an international faculty with a vast track record in training corporate officers and a truly extensive and varied corporate governance experience. Faculty will have good knowledge of the Greek regulatory environment and corporate practice.

What will you gain?

• A very good understanding of the Greek/EU legal and regulatory requirements

• Practical aspects of creating and running a good board

• What is (and will be) expected of you by investors and providers of funds (including banks)

• Practical tips on how to communicate non-financial information to markets and stakeholders.

• Practical aspects of creating and running a good board

• What is (and will be) expected of you by investors and providers of funds (including banks)

• Practical tips on how to communicate non-financial information to markets and stakeholders.

Who should attend?

• Board members of listed companies, actual and aspiring

• Board members and key shareholders of larger private companies

• Senior executives that report to the board

• Executives that support the board or its committees

• Others with an interest in ESG and corporate governance matters

• Board members and key shareholders of larger private companies

• Senior executives that report to the board

• Executives that support the board or its committees

• Others with an interest in ESG and corporate governance matters

Information

Due to ongoing COVID-19 measures, our seminars will take place online.

Please contact us for currently available options of seminars held in the English language.

Information - Contacts

For more information, please contact us at HCGC's contact services

Please contact us for currently available options of seminars held in the English language.

Information - Contacts

For more information, please contact us at HCGC's contact services

- 2021 HCGC © All Rights Reserved

- |

- Privacy Policy

- |

- Cookie Policy