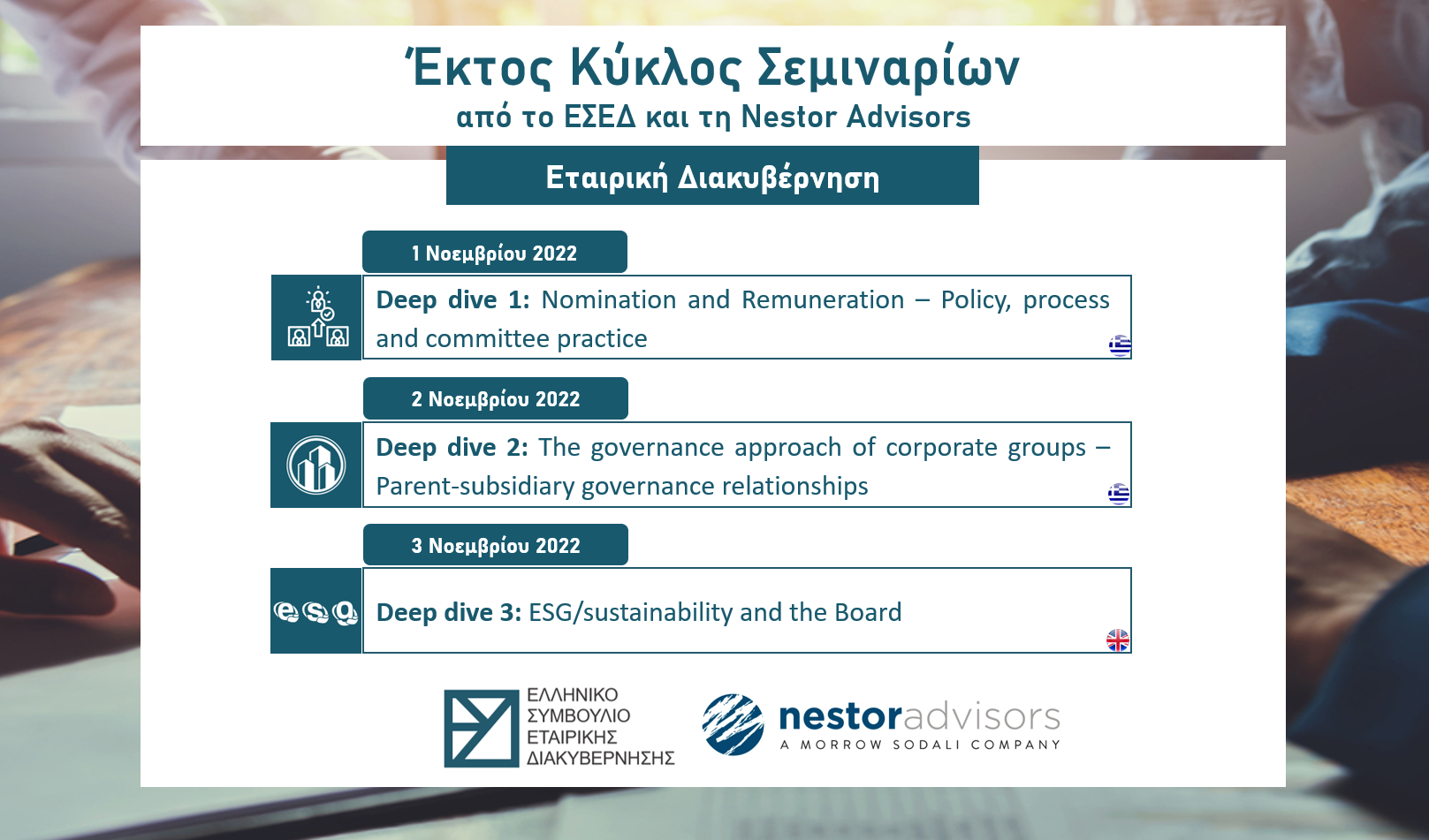

CG Seminar 06

"Best Practices in Corporate Governance: Boards, executives, investors, stakeholders”

Ημερομηνίες διεξαγωγής: | 1-2-3 Νοεμβρίου 2022 |

Τελευταία ημέρα υποβολής αιτήσεων: | 31 Οκτωβρίου 2022 |

Σύνολο ωρών: | 9 |

Γλώσσα διδασκαλίας: | Ελληνική - Αγγλική |

Τρόπος διεξαγωγής: | Το σεμινάριο θα διεξαχθεί μέσω Zoom |

Κόστος συμμετοχής: | Κόστος πακέτου επιλογής + Φ.Π.Α. (24%) |

Course description

Deep dive 1: Nomination and Remuneration – Policy, process and committee practice – in Greek

01 November 2022

- How to set up the board for success: board profile and composition, board responsibilities and oversight, expectations and practices.

- Relevant remuneration trends and practices: how is the landscape changing and what are the changes in Greece?

Deep dive 2: The governance approach of corporate groups – Parent-subsidiary governance relationships – in Greek

02 November 2022

- What are the key concepts and challenges in group governance?

- How should one go about developing and implementing group-wide policies?

- What is the role of subsidiary boards vis a vis parent boards?

Deep dive 3: ESG/sustainability and the Board – in English

03 November 2022

- What are the key concepts and challenges in governing E&S?

- What is the role of investor expectations in E&S?

- How should boards’ responsibilities and composition be structured to address E&S?

• All workshops are designed to be highly interactive, with a practical orientation. Throughout the workshops, live polls will be used to interact with the audience and participants may be asked to apply knowledge learnt to arrive at recommendations to mini-case problems. They will be run by an international faculty with a vast track record in training corporate officers and a truly extensive and varied corporate governance experience. Faculty will have good knowledge of the Greek regulatory environment and corporate practice.

01 November 2022

- How to set up the board for success: board profile and composition, board responsibilities and oversight, expectations and practices.

- Relevant remuneration trends and practices: how is the landscape changing and what are the changes in Greece?

Deep dive 2: The governance approach of corporate groups – Parent-subsidiary governance relationships – in Greek

02 November 2022

- What are the key concepts and challenges in group governance?

- How should one go about developing and implementing group-wide policies?

- What is the role of subsidiary boards vis a vis parent boards?

Deep dive 3: ESG/sustainability and the Board – in English

03 November 2022

- What are the key concepts and challenges in governing E&S?

- What is the role of investor expectations in E&S?

- How should boards’ responsibilities and composition be structured to address E&S?

• All workshops are designed to be highly interactive, with a practical orientation. Throughout the workshops, live polls will be used to interact with the audience and participants may be asked to apply knowledge learnt to arrive at recommendations to mini-case problems. They will be run by an international faculty with a vast track record in training corporate officers and a truly extensive and varied corporate governance experience. Faculty will have good knowledge of the Greek regulatory environment and corporate practice.

What will you gain?

• A very good understanding of the Greek / EU legal and regulatory requirements

• Practical aspects of creating and running a good board

• What is (and will be) expected of you by investors and providers of funds (including banks)

• Practical tips on how to communicate non-financial information to markets and stakeholders.

• Practical aspects of creating and running a good board

• What is (and will be) expected of you by investors and providers of funds (including banks)

• Practical tips on how to communicate non-financial information to markets and stakeholders.

Who should attend?

• Board members of listed companies, actual and aspiring

• Board members and key shareholders of larger private companies

• Senior executives that report to the board

• Executives that support the board or its committees

• Others with an interest in ESG and corporate governance matters

• Board members and key shareholders of larger private companies

• Senior executives that report to the board

• Executives that support the board or its committees

• Others with an interest in ESG and corporate governance matters

Πληροφορίες

Τρόπος Διεξαγωγής

Λόγω των προληπτικών μέτρων έναντι του COVID-19, τα σεμινάρια θα λαμβάνουν χώρα εξ' αποστάσεως.

Τρόπος Πληρωμής

Τα δίδακτρα κατατίθενται στην Τράπεζα Eurobank, αριθμός λογαριασμού 0026-0240-31-0201156674 ή IBAN GR79 0260 2400 0003 1020 1156 674. Το καταθετήριο της Τράπεζας, με το ονοματεπώνυμο του καταθέτη, θα πρέπει να αποστέλλεται στο Ελληνικό Συμβούλιο Εταιρικής Διακυβέρνησης (ΕΣΕΔ) μέσω ηλεκτρονικού ταχυδρομείου στο: info@esed.org.gr

Πληροφορίες - Επικοινωνία

Για περισσότερες πληροφορίες μπορείτε να επικοινωνείτε μέσω των στοιχείων επικοινωνίας του Ελληνικού Συμβουλίου Εταιρικής Διακυβέρνησης (ΕΣΕΔ)

Λόγω των προληπτικών μέτρων έναντι του COVID-19, τα σεμινάρια θα λαμβάνουν χώρα εξ' αποστάσεως.

Τρόπος Πληρωμής

Τα δίδακτρα κατατίθενται στην Τράπεζα Eurobank, αριθμός λογαριασμού 0026-0240-31-0201156674 ή IBAN GR79 0260 2400 0003 1020 1156 674. Το καταθετήριο της Τράπεζας, με το ονοματεπώνυμο του καταθέτη, θα πρέπει να αποστέλλεται στο Ελληνικό Συμβούλιο Εταιρικής Διακυβέρνησης (ΕΣΕΔ) μέσω ηλεκτρονικού ταχυδρομείου στο: info@esed.org.gr

Πληροφορίες - Επικοινωνία

Για περισσότερες πληροφορίες μπορείτε να επικοινωνείτε μέσω των στοιχείων επικοινωνίας του Ελληνικού Συμβουλίου Εταιρικής Διακυβέρνησης (ΕΣΕΔ)

- 2021 HCGC © All Rights Reserved

- |

- Privacy Policy

- |

- Cookie Policy